Current Outlook

Nowadays, claims settlements take an average of 42 days from the reporting stage to resolution of the case, not counting the little or no communication with the insured. Strongly impacting on the insured’s experience and consequently on the renewal of their subscription.

On the other hand, the cost of operational handling of claims greatly impacts the results of the companies, where they are made up of a large number of intermediaries and which results in little control over the management of the process.

At LISA we faithfully believe that claims are the moment of truth in insurance, it is the main reason why we take out a policy and this can be summed up in: feeling accompanied and relieved if a risk becomes a reality. The rhetorical question is when we take out fire insurance «We hire it thinking that it will take more than 40 days to compensate?» The truth is that no, we contract the insurance thinking that it is resolved as soon as possible in a reasonable time, but how much is reasonable?

We asked the insured regarding their expectation, they expressed the following critical and expected points at the time of a claim:

- «I would ask for catastrophic insurance to be paid in a maximum of 2 weeks.»

- «That they always keep in touch with me, especially to know the status of the claim processing.»

- «That they ask me for all the information at once to collec and send them at once.»

- «That the sending of these documents is as expeditious as possible and hopefully digitally.»

- «That during the complaint they do not ask me for so much information that the company already has.»

- «Don’t make me go to a branch if it’s not necessary.»

Classification of Home Claims

These are divided into two main types: Catastrophic (40 days) and Non-Catastrophic (20 days).

The coverages of this type of insurance are made up of various forms, among which we find: fire, earthquake, broken pipes, broken glass, risks associated with nature, earthquake and theft.

What we are clear about is that 85% of the monthly loss ratio is not catastrophic and that only 15% is, which is why it can clearly be streamlined using the Pareto method at least the non-catastrophic ones with that focus. That is why, at LISA, we are seeking to expedite the settlement of non-catastrophic claims through a Fast Track method at least.

Meet our proposal for the Fast-Track, it is short and friendly!

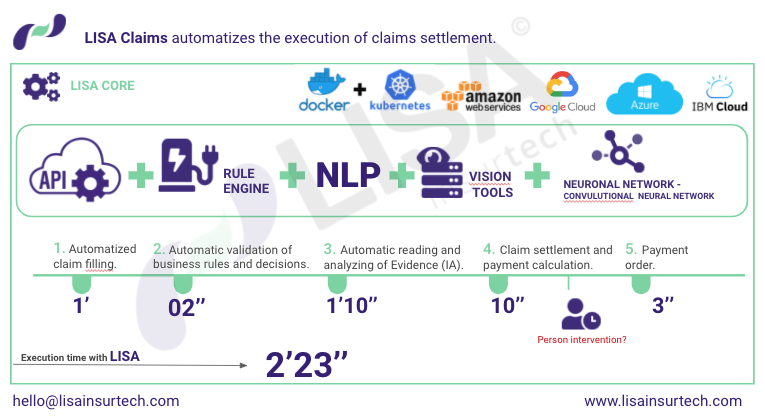

1.The efficient method but still anchored to the traditional: a form without much friction for the client, which gives us the basic indications to look for the policy and its validity, then a box where all the evidence is loaded. Then, after analyzing the evidence and the case, in just two minutes, the adjustment will be made available for the internal or external liquidator of the company to give its approval (in a few minutes).

Finally, the compensation will pass with LISA in one hour to the payment area and then the last adjustments of the process will be made to complete the payment in the account, in about three days.

2.The efficient and disruptive method: analyze the evidence and the case in minutes, with which LISA will go to compensation in 10 minutes to the payment area and through our alliance with VISA Direct our payment gateway can be used in order to issue the Dispersion of the Payment automatically and that the transfer reaches maximum the next day.

And what will happen to the attention of the remaining 15% of the monthly claims that are catastrophic (40 days), LISA also manages the entire life cycle, including the external service management actions and proposes to reach 12 days as a goal to settle the case, thus fulfilling the promise.

With the above, we undoubtedly seek to sustain our value offer every day that points to the perfect triad: Decrease in time, cost and increase in customer satisfaction. if you don’t know it this is:

«Settle insurance claims by reducing the settlement time by 80%, reducing the cost of handling claims by 60% and increasing the NPS of the insured by 20% in the first 3 months.»

If at Home we can do it in two minutes, imagine what we can achieve in LIFE, HEALTH, Major medical expenses, Mandatory Personal Accident and Traffic Insurance (SOAT / SOAP), Tax Relief.

If you are an insurance or Banking insurance incumbent, now you are aware that you can implement this type of improvement in your lines of business, that is why you can request your DEMO by clicking here and let’s talk about your particular line.

Welcome to the future with LISA!